Thursday, December 4, 2008

Support Rep. Louis Gohmert's Tax Holiday!!!

Wednesday, November 26, 2008

Why Buy the Cow...

Saturday, November 22, 2008

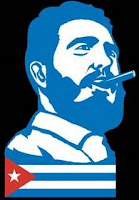

Living In An Obama-Nation

A good friend of mine sent me this video and it got me to thinking about what the next 4 years will really be like from an economic perspective. I am generally not a gloom and doomer, conspiracy theorist, or all around crackpot...ok, maybe a gloomy conspiracy crackpot, but definitely NOT a doomer theorist, besides, doom science is beyond the scope of this blog. I do, however, think we need to plan accordingly for what may be a major shift in our economy as a result of significant policy overhauls.

Tuesday, November 11, 2008

Is it just me...

Saturday, November 8, 2008

Free Markets in Under 30 Minutes Or Its...Well, Free!

Saturday, November 1, 2008

Selfishness Is a Virtue

With only a few days left before the election, there has been a lot of talk about the candidates' positions on the capitalism-socialism scale. Before I go any further let me just say that BOTH candidates are not true free market capitalists, which is what I am (as if you couldn't tell already). They have both advocated socialist policies in one form or another that hurt the economy. There is only a distinction between how extreme one is to the other. After the "spread the wealth" comments by Obama to Joe the Plumber, the public (with no help from the media) has begun to ask just how far down the socialist scale he really is. Well, I am not a rocket scientist, and I didn't even stay at a Holiday Inn Express last night, but my mom did tell me once that you could tell the soul of a person by who they associate with. After 20 years of listening to the anti-capitalist rants of Rev. Jeremiah Wright, hanging out with the anti-capitalist (and terrorist, but that is irrelevant to this discussion) William Ayers, mentoring under the anti-capitalist Frank Marshall Davis when he lived in Hawaii, and his love of the works of anti-capitalist Saul Alinsky, my mom would say you can get better than even odds in Vegas that he is a socialist, regardless of what he said in his infomercial.

When challenged on this he simply said he was not a socialist, only he doesn't think "selfishness is a virtue". By this I guess he meant that free market policies are selfish, and by extension, socialism (which he does not believe in, just in case you don't like socialism) is not selfish. I would argue that the evidence shows both are selfish, but for different reasons and vastly different results.

Capitalism IS selfish. That is how it was designed and also the inherent beauty of it. We live in a fallen world, full of selfish people, so a system that actually channels that selfishness into a flow of capital that benefits other people while fulfilling the goals of the selfish individual is brilliant. For example, you want to provide for you family, so you selfishly start a business that sells widgets. In the process you had to hire other selfish people who only wanted a paycheck to provide for their families. They work to produce high quality widgets because they selfishly understand that they will get more money from you if you sell more than your selfish competitors. The widgets are bought by other selfish businesses run by selfish people who use your widgets in their contraptions. They only buy your widgets because they want to make a profit from their contraptions. Those contraptions are sold to selfish people who use them for their own selfish enjoyment. Never does the business owner make the widgets for the sole reason of employing people. The contraption makers never once thought of buying widgets in order to put food on the widget maker's table. The contraption buyer is interested only in one thing...high quality contraptions. However, through all of this selfishness, many people are employed, many families are fed, and contraption enjoyment is at an all time high. Life is good.

Socialism is also selfish, although it claims not to be. From each according to his means to each according to his needs. To some this may sound like a noble way to provide for everyone. Certainly it doesn't sound selfish. But if we look deeper into the consequences of such a policy we see plenty of selfishness at work, and it benefits no one but the selfish. If you know that someone who works harder and achieves more will be there to provide for you, what is your incentive to be successful? If you achieve success you will have to involuntarily give it away to those who choose not to. So the achievers become selfish by producing less so as to pay less while those not as successful become selfish by expecting to get something for nothing. Those who administer this redistribution of wealth know that the only way they can keep this system in place is to have a large enough group of unsuccessful people to keep voting them into power. Keeping others down so as to ensure your own success is certainly the epitome of selfishness. In extreme cases, such as communism, the only way to get anyone to produce wealth that can then be confiscated is to remove all choice and force them to do so with the threat of violence. In all cases, these policies lead to reduced productivity, lower wages, unemployment, less charitable giving that truly helps those in need and the destruction of the human spirit which was designed to achieve. This has been the case everywhere centralized command and control economies have been implemented.

So, which version of selfishness is better? Just look at the standard of living, levels of charitable giving, resources provided to those in need, and opportunities to move from poverty to wealth between countries with free market policies and those with socialist ideals. Which is virtuous?

Tuesday, October 21, 2008

Taxes: Income of Government or Tool of Fairness?

There are two schools of thought on taxes. The first, the one that the Founding Fathers believed in, is that taxation was income to be used to pay for essential government services enumerated in the constitution. The second view is that taxes should be a used to redistribute wealth or to enforce "fairness" between the haves and the havenots. There is really only one way that works and that is income for the government, because using the tax code to make things fair will actually hurt the very people you are trying to help.

As we talked about before, when the cost of something goes up, demand for that product or service goes down. A tax is simply a cost added to a product or service. When a tax is imposed on an activity, it leads to less activity. This is easy to illustrate in everyday life. When gas prices started to rise, the increase was like a tax that you didn't have to pay before. As that increase got larger, you tried to buy less gas. Maybe you bought a smaller car or started carpooling. You used less gas because it cost more. Its the same thing with income or sales or property taxes. The higher it goes, the less of that activity occurs.

An income tax is a tax on productivity. When taxes go up, people produce less. And actually, there is a point where if taxes were high enough, you wouldn't work at all. Just think about it, if you were taxed at 100% there would be no reason to produce. What about 90%, 80%, 70%? I would find it difficult to get out of bed everyday if that much of my money were going to the government.

Now for a quiz... what is it that allows people to earn an income to buy stuff? A job. What creates jobs? Wealth that can be invested in a business that needs employees. What creates wealth? Profit from that business. And finally, what creates profit? I know that you are saying to yourself "Why profit comes from an imperialistic country stealing from the poor people of the world." Sorry, silly socialist, but poor people don't have enough money to steal. Only rich people. So since stealing is illegal in rich countries, how do you separate money from rich people? You make stuff they want and sell it to them! That is called productivity. And if you tax it, you get less of it. Which means fewer happy rich people, less profit, lower wealth, fewer jobs, and you in the unemployment line where the government divvies out the tax revenue they took from everyone so as to make things fair for everyone.

So my point of all this is that the very tool the pro-tax crowd claims is supposed to help the poor and downtrodden is actually hurting them! The best way to help raise people's standard of living is to take the shackles off of productivity and allow wealth to be created unimpeded. Now I am not saying that this would eliminate poverty, because there will always be poor people for various reasons, often of their own choosing. But if we allow anyone who wants to change their lot in life the best chance to do it, then our entire society will benefit, even those that don't want to work. Just compare our "poor" to that of other countries that promote socialist policies. There is no comparison. A rising tide really does lift all boats. We have the highest productivity of any nation on Earth, and as a result one of the highest standards of living. Why in the world would we want to be like everyone else? We should ask this of our leaders as well...

Saturday, September 27, 2008

Source of Our Economic Problems - the Tunnel of Affirmation

Then this morning the answer hit me. We went to my son's soccer game. They practice hard and really work on passing and shooting skills. The defenders on the team are taught to get the ball as far away from their own goal as possible. Control risk, wait for opportunity, and strike when the iron is hot...or in this case, when the other goalie falls down. As a result of practicing the basic tenants of soccer, our team won, shutting out the opponent 4-0. If you know anything about soccer (and believe me, I tried to steer them to a sport more enjoyable from the stands...) you know that a 4-0 score is like 100-3 in football...it was not even close. When the game ended, the fans from the other team walked out on the field, spread out in two lines, joined hands across the void and said "c'mon everyone, lets form the tunnel!" To their credit, only one of the kids walked through it while the grown-ups all yelled "woot! woot!" (that's a verbatim quote) over and over. My wife and I stood there in stunned silence as we watched this incredible celebration of failure. My wife named it the "Tunnel of Affirmation", to which I had to fight back laughter to keep the condescending stares of the losing side's bridge supports from focusing on me.

I am not trying to make fun of a kid losing a game. Losing is a part of life. I have felt the pain of losing and it can be terrible. But if we never feel that pain, then we never learn how not to lose the next time. If everyone walks through the Tunnel of Affirmation or gets a trophy at the end of the season regardless of accomplishment then we never learn what it takes to succeed. We only learn that we are entitled to praise and affirmation just because we exist, and while this would be an enjoyable way to live, it just doesn't prepare kids for real life, which is what we as parents are supposed to do.

So what does this have to do with the current state of affairs? Well, when people don't understand winning or losing you get all of the participants in this mess. First, you have people who don't think they should need to pay their bills on time in order to be trusted for a six figure loan on a house. When they lost their soccer game, they walked through the Tunnel of Affirmation. Then you have government types that think its unfair to deny mortgages to those people, regardless of what those risks mean to the solvency of the lending bank. When they lost their soccer game, they walked through the Tunnel of Affirmation. Those loans are bought up by people at FNM and FRE who think that because the taxpayer is guaranteeing them that they can use the system as their own personal penny bank without regard for the principles of risk management. When they lost their soccer game, they walked through the Tunnel of Affirmation. When those loans are defaulted on, the very politicians who created this environment of subprime lending, act indignant and blame the free market for it. When they lost their soccer game, they walked through the Tunnel of Affirmation.

No one wants to be held responsible for their actions anymore. They don't want to be held accountable. They want to win even when they don't deserve it. I am almost certain its because when they lost their soccer game, they walked through the Tunnel of Affirmation.

Friday, September 19, 2008

Bailouts, Bailouts Everywhere…

…but not a drop of common sense in D.C.

Unbelievable. Apparently my fantasy that Ben Bernanke reads my blog was shot to smithereens. Only a day after I praise the decision to pass on a bailout of Lehman Brothers, they decide to go ahead and make you and me the proud owners of a poorly run insurance company. Why? Because it is "too big to fail". In the latest fiasco, the federal government (that's the you and me part) paid <Dr. Evil voice> 80 BEEEELION DOOOLLARSSS </Dr. Evil voice> for an 80% stake in AIG. The company will finally live up to its name…American International Group. That's the only funny thing I can find in it.

The argument that something is too big to fail is compelling on the surface. It is logical to assume that if AIG were to close shop, there would be many external effects on the economy. Others who rely on AIG would have to find alternatives, and in many cases it may cost them their financial well being. This is unfortunate and a byproduct of not allowing the markets to correct themselves in a timely manner. There is a fundamental concept in economics that there is no such thing as a free lunch. What this means is that everything comes with a cost. If the government is giving money to one person, they have to take it from another. It seems free to the recipient, but in reality, it is not. If we artificially prop up a business that is not able to make it on its own, it comes at a cost to those that have to put up the money. Again, that is us. So instead of the people involved with the failing business paying the cost, like the shareholders and management, it is shifted to those of us that have nothing to do with it. This is always the case with a bailout.

This would be bad enough if it stopped there, but like a good infomercial…wait, there's more! When a person or business is not held accountable for their bad behavior, but instead are made whole at the expense of others, it only encourages more of the behavior that got them into the problem in the first place. These financial companies made bad investment decisions by not properly accounting for the risk of those investments. Now, these are professionals, many with vaunted Ivy League credentials, and were certainly taught risk management at those places. So why would they do that? Because they know that if it all goes bad, the government will be there to make it better because they are "too big to fail." By bailing out these firms in order to prevent the negative consequences of their actions on the economy, the government is actually creating more strain because they allow bad firms to keep running, and encourage others to take on too much risk.

Another example that may help in understanding this is government subsidized hurricane insurance. No one wants someone else to lose their home in a hurricane, but should other people pay to replace that person's home? Is there no accountability for deciding to live in a place with a high risk of getting hit by a hurricane? It is very expensive to buy hurricane insurance. Why? If you live on the Gulf Coast, there is an extremely high likelihood that your property will have to survive a hurricane at some point during your ownership of it. The risk to an insurance company is very high and so the resulting premiums, set by the free market competition between insurance companies, are high. The government wants to "help" people by paying for part of the insurance cost. So when a hurricane comes, the home owner gets reimbursed by other taxpayers, most of whom chose a more responsible place to live. They then rebuild their house, in the same risky place, never learning the lesson that should have been learned.

It is fundamentally unfair to force you and me to pay for the folly of others. It is no different whether it is hurricane insurance or AIG or Countrywide or Lehman. The losses should be borne by those responsible for them. This is the only way that foolish behavior can be cut out of the marketplace. When you touch a stove and somebody else gets burned, you will keep touching the stove. That is, until those getting burned start picking up pitchforks and march on your kitchen…

Monday, September 15, 2008

Role of Government Rant #1

In the wee hours of the morning on Monday, Lehman Brothers, a 158 year old Wall Street brokerage firm, filed for bankruptcy. This action will effectively bring the company to an end. As a result, 26,000 employees will have to find other work. Now I feel sorry for each and every one of them, as most of them had little to do with the failure of the firm. But I was listening to NPR this afternoon and they were interviewing employees as they came out of the building.

Many of these employees are Ivy League educated and have presumably had classes in economics. However, one of the interviewees made me doubt my assertion when he was asked if he thought the decision not bail out Lehman by the American tax payer was a good idea. His answer was that it should have been a no-brainer. He couldn't believe there would not be a bailout. How could the government allow Lehman to fail? He finished it off with a snide comment about how much money is spent in Iraq. Presumably he feels that that money could be better spent giving Lehman more money to squander since they ran out of their own. Or perhaps he just feels like he is owed a job and a paycheck. Either way he had me yelling at my radio, which looks really odd to the person in the car next to you.

Who does this guy think he is asking me to pay for his errors? Maybe he didn't personally ruin Lehman brothers, but he certainly contributed through his employment there. In the free market, inefficient use of capital will be replaced by more productive capital...that is, unless the government takes your money and gives it to the inefficient capital users like Lehman so that they can continue in their folly. A better solution, is to allow these firms to fail. They will file bankruptcy, and the investors who willingly took the risk to invest in them, will foot the bill rather than the taxpayer.

This will have two effects that result in more efficient use of capital (and hence more wealth creation.) First, the people responsible for the failure will be held accountable for their poor decisions, hopefully never being given that responsibility again. And second, the investors who lost money will now be better evaluators of risk when putting future capital to work. They will demand more accountability. They will be more cautious, more efficient. This is the natural corrective mechanism of the market. If we don't allow it to operate properly, then we can't complain when things aren't working.

Since the government knows less about running a business than the idiots that sank it, then why would we give them the reins to take over and throw good money after bad? Why should life long politicians, most of whom couldn't run a faucet, much less a business, be deciding what businesses should be saved? Let the market decide! The agregate deciscions of shareholders and customers...the market...ultimately make the best choices. It can be painful, for sure, especially when the problem has been created or fostered by unaccountable management and over reaching governement. We can keep management accountable by becoming informed investors. We can keep government from over reaching by voting. It should be up to us...the market.

Ok, I feel much better now.

Saturday, August 23, 2008

Speculator - Friend or Foe?

Now everyone loves a scapegoat, because it makes us feel better about things we have no control over. But this issue of speculation has become one of the biggest targets of congress during an election year where they want to do anything but blame themselves for high gas prices. As a trader myself, I have long understood the benefits of an active, liquid market. But apparently those smart enough to get elected to congress have absolutely no clue as to how markets work to find the true price of a commodity. I hope that in this post I can clear up the role of speculators and how they actually benefit society and keep prices in check.

First of all, we need to define what speculation is. Speculation is any action where you buy or sell something in anticipation of a future event that will affect that something. When you buy a good or service in a market its for one of two reasons. You either have a immediate demand for it that must be met with supply, or you think waiting to purchase it later will be more expensive.

Lets use an example. At some point today you will need a roll of toilet paper (or in my 3 boys' cases, 2 rolls, but we are still teaching them conservation). By the way, if this example does not apply to you then I recommend seeing a doctor. Now, you could go an buy one roll at a time, just as you need it. This would fulfill the first purpose of a market. Your immediate need is met. But in a couple of days you will need more. Buying one roll at a time would get inefficient, using more gas in the car, dealing with more Walmart cashiers, etc. Not to mention the risk that the price of toilet paper will rise by the time you need another one. The other option would be to go to your favorite warehouse club and buy the pack of 240 rolls. Now, this would save you a lot of time and money, but you would also get some strange looks from others in the store. This is especially bad if you are also buying cans of chili in bulk, trust me on this one...not that this has ever happened to me or anything. Well, moving on...even though you are saving money on bathroom tissue, you have other problems, like how to get it in the trunk of your Prius or where to store it all when you get it home. Well these problems happen all the time in the commodity markets. General Mills needs wheat for cereal, McDonalds needs beef for Big Macs, and Nestle needs cocoa for my son's addiction to Quick. How do they protect themselves from price increases so that they can manage their costs and compete with others? And what about the farmers who have these products and want to plan their operations for the next year? They need to control fluctuation in price as well.

This is where the futures markets come in. They are market places where producers can sell their grain/meat/cocoa before it is actually ready and companies like General Mills and Nestle can lock in a price for the product that they will use in the future. The other participant in these markets is the speculator. This is where you buy or sell the product in anticipation of a price changes in order to, hopefully, make a profit. Everyone is a speculator to some extent. When you bought those 240 rolls of tp, you were locking in a price for the near future. Had there been a dramatic increase in the price of toilet paper over the next few weeks, you could have sold some to your neighbor for the going price and made a profit. You weren't evil for doing so, you were just reacting to the fundamentals of the market that caused toilet paper prices to rise. In the futures market, a speculator is not even buying the actual product, but rather a contract to buy or sell it in the future at the agreed on price.

Speculators provide liquidity between the producers and consumers in the market. They are constantly buying and selling so that at any time you want to place a trade, there is someone on the other side of it to fill your order. They decide if they want to buy or sell by analyzing various data in the market. They may look at farm reports or government data or even simply patterns of price action on a chart of the commodity's price. They are not always right either. Speculation is very risky and many people lose all of their money when they try it. If you don't understand a market then you can bet there is someone else that knows more than you and will take the other side of your trade. Its all this buying and selling that leads to an efficiently priced market where all of the fundamental data that is known is factored into the price. If this activity were not going on, a farmer would never know how much his crop will be worth and from there, be unable to plan how to best use his farmland. The same applies to any market. Speculators act as a price seeker, constantly searching for equilibrium in the market, as we talked about in the previous post. This insures you will always pay the fair market price for something.

So, with all of that, how does it apply to oil? First of all, speculators are not buying or selling the actual physical commodity. The cash price of oil is not dependent on what speculators think it will be three months from now, but rather the other way around. Speculators look at the supply and demand picture today and then try to extrapolate where they think prices will be in the future. They actually provide a valuable service to the marketplace by signalling to oil companies where the price may be headed. If futures prices are high, oil companies will step up production in anticipation of selling into the higher prices. This results in more supply on the market, which then leads to a decline in prices. As this supply data is dispersed to the market, speculators take that information and sell their contracts, pushing futures prices lower, and the cycle repeats. Ultimately, this leads to consumers getting the "fairest" price based on the overall supply and demand picture, not on the "profiteering" of oil speculators.

Whew, this has turned into a long post, and I have only scratched the surface. I try to explain the basics so that the major misconceptions can be cleared up, but if anyone reading this has other questions about it, please post them in the comments section and I will try to address them in future posts. Now, I need to attend to lunch, the chili is almost ready!

Saturday, August 2, 2008

Supply and Demand - The Basics

The basic supply and demand graph is pretty simple. On the x axis we have the quantity of a good or service and on the y axis we have the corresponding price of the good or service. Demand is plotted as a curve moving from high to low as we move to the right. This illustrates how demand works. As the price of a good or service falls, the quantity demanded of it increases. You have probably experienced this when you go to the dollar store and see that a pack of 32 ping pong balls only costs a buck, whereas Walmart sells them for $2. So you buy 13 packs of them. I mean, what a bargain! I would have only bought 5 packs at that ridiculous Walmart price. Now, I know I am not the only one that has bought 416 ping pong balls on an impulse. ...Hey, stop judging me!

The supply curve works the opposite way. It goes up as we move to the right because as the price rises, more of the good or service becomes available. As the price that people are willing to pay for ping pong balls goes up, the more ping pong ball suppliers are willing to make because there is a lot of money in ping pong balls (like, no duh!). Its where these two curves meet, that producers sell the most ping pong balls that the consumer is willing to pay that price for and the consumer gets the lowest price the supplier is willing to sell that number of ping pong balls at. This point is called the equilibrium. At this point, everyone is happy (except your wife).

Lets say, hypothetically, that you really like ping pong balls but your wife says, hypothetically, that you are a lunatic for buying 32 packs of them. So now you need to sell them. You put them on Ebay and set the Buy It Now price at $3 per pack, already figuring up how much bubble wrap your profits will buy. By the end of the auction, you start to think that people don't appreciate the implements of table tennis like you do. The winning bidder STEALS them from you for a measly 25 cents per pack (probably those evil Walmart people, taking advantage of the less fortunate). My, errr... I mean your original price was clearly too high since it did not attract any buyers. When the price is too high, there are less buyers than sellers which leaves a lot of balls on the market. This is called a surplus of balls. When the price is too low, there are more buyers than sellers and there are not enough balls for everyone (probably Bush's fault, but I digress...). This results in a shortage of balls. Both surplus and shortage represent inefficient use of ball capital. In a perfect world, we would always be at equilibrium, everyone would get exactly the number of ping pong balls they want. And what a world that would be... But in most cases, the market is in a constant flux, moving from surplus to shortage as all of the participants try to get the best deal or make the most profit. When left alone, the market will come pretty close to equilibrium most of the time. Its when we try to force it one way or the other that the problems begin.

Now, whenever you hear something on the news about the economy, you can refer back to the graph to see if that makes sense or not. We will use that graph a lot as we look at various issues in future posts. Remember, the laws of economics work whether or not we want to believe they do. Just like hypothetical wives consider closets full of ping pong balls to be "stupid" whether we believe it or not...I'm sure she will feel differently about the bubble wrap.

Sunday, July 27, 2008

Welcome to my blog!

The purpose of the blog is to provide an outlet for my screaming at the television, something I find myself doing more often these days, as the amount of complete crap that is spewed as fact has increased to a level surpassed only by the number of embarrassing moments in the life of Brittney Spears. What is clear to me is that they are no longer teaching economics in school or if they are, everyone is sleeping through it. Now I know that econ has always been one of the best classes to sleep in, especially considering most of the professors sound like Ben Stein, but it will affect our lives more than anything else we learn in school. Well, actually, if you DO sleep through econ class, learning to spell you name correctly on the unemployment application will arguably be more important.

You may be asking yourself how I could possibly have the expertise required to correct the great minds at World News Tonight or the show that thought Katie Couric as a replacement for Dan Rather was a better idea than just scrapping the whole operation. Well, I'm not an economist, but I am a slightly overweight white guy, and that is more than I can say for Katie. Actually, I did manage to stay awake in economics class long enough to get a degree in it from Auburn University, which as everyone knows is world renowned for having a great football team, so that should shut up the critics. Ok, enough about me. No one is even reading this, so its like I am talking to myself about myself, which is just creepy. In any event, I hope to be informative, relevant, sometimes funny, but always truthful and never hyperbolic. And it might even save your life!